At any time of year - especially in the winter months - utility bills can feel like a never-ending stream of expenses, made even more challenging as utilities become more costly over the decades.

According to Energy Star, the average single-family US household spends $2,060 per year on utilities. Saving even 10-20% on this amount could mean considerable savings.

Most experts suggest that households should plan to spend 5% to 10% of their annual income on utilities. Depending on where you live, that target can be out of reach.

Heating and cooling, water, power, and lighting are the main areas where you can cut down your utility bills. You can save big when you put in place practical tips to help you save on your utility bills without sacrificing your comfort or lifestyle.

If your utility bills put a crunch on your budget, the following tips can help - potentially saving you 20% or more on your annual bills.

Mindful Heating and Cooling

One of the biggest contributors to high utility bills is heating and cooling your home. Be mindful of your thermostat settings. In the winter, lower the temperature a bit and wear cozy sweaters, and in the summer, raise it a few degrees while using fans to keep cool.

You can save on heating and cooling by simply turning your thermostat back seven to 10 degrees for eight hours a day from its normal setting. Those eight hours could be while you are away at work or school, when sunlight is warming your house, or when you're asleep under a pile of cozy blankets. While this might not be an option for every family, you could experiment with turning back the heat when the household is empty even a few hours a day.

Set it and forget it with a programmable thermostat to automatically turn your heat down at night or when you are away. This prevents you from forgetting and helps you save energy without even thinking about it!

Seal Those Leaks

A drafty home is an energy-hungry home. Inspect doors and windows for gaps and cracks and use weather stripping or caulk to seal them. This simple step will help maintain a consistent temperature indoors and reduce the load on your HVAC system.

Affordable DIY ways to improve energy efficiency can save you about 7.5 percent on your energy bill! About $240 can cover weather stripping all your windows and doors. Check out Energy.gov and YouTube for how-to videos and tips.

Additionally, minimize the air that escapes by closing the damper on your fireplace when it’s not in use, and use bath and kitchen fans sparingly. This can also be an option to save on your energy bill.

Switch to Efficient Lighting

Swap out those old incandescent bulbs for energy-efficient LED bulbs. They last longer, use less energy, and provide the same warm and inviting glow. Plus, they’re a breeze to install!

Check out these numbers – households typically spend 5% of their energy budget on lighting, but replacing frequently used bulbs with ENERGY STAR models (including some halogen incandescent, compact fluorescent lights, and LEDs) can save you $45 a year!

Call in the Energy Pros

Many utility companies offer free energy audits, which can help you figure out how much energy your home uses and take steps to increase efficiency. Start by contacting your utility company or find an auditor near you. According to Energy.gov, an energy audit can show you ways to save 10 – 20 percent on your utility bills.

Unplug and Power Down

Did you know that many appliances and electronics continue to use power when plugged in, even if they’re turned off? To save on your utility bills, unplug devices or use power strips to easily cut the power to multiple devices at once.

The United States Department of Energy reports that homeowners can save anywhere between $100 and $200 each year by unplugging devices not in use. Typically, an item drawing a single watt of energy costs about one dollar to power annually.

Save Water, Save Money

Heating water can make up around 12% of a family’s utility bill, according to the Department of Energy. Installing low-flow showerheads and faucets can significantly reduce your water consumption, which, in turn, lowers your water heating costs. It’s a win-win for your wallet and the environment.

Save water in other ways, too. Wait until you have a full load before running your washing machine or dishwasher. Use cold water for laundry whenever possible, and air dry your clothes instead of using the dryer.

GE Appliances estimates that 75-90% of a washer’s energy is used to warm the water, so switching to cold can help reduce your energy bill — and still be effective at removing stains and keeping clothes clean!

Regular Maintenance and Upgrades

Don’t forget to schedule regular maintenance for your appliances, including your HVAC system. Clean or replace filters, check for leaks, and ensure your system is running efficiently. A well-maintained system works less and saves you money.

The numbers tell the story about the importance of maintenance. Your furnace or heating system is responsible for about half of your energy bill. Changing the filters every three months means your furnace doesn’t have to work as hard, saving you energy and money in the long run. A clean filter costs about $20 and can lower energy use by as much as 15 percent according to the U.S. Department of Energy. That means another 7.5 percent savings on your monthly bills.

Are your appliances running efficiently? Check the performance of your refrigerator, washer and dryer. If you have appliances that are more than a decade old, consider upgrading to energy-efficient models. Look for the ENERGY STAR label when shopping for new appliances—they use less energy and can save you money in the long run.

Monitor and Track

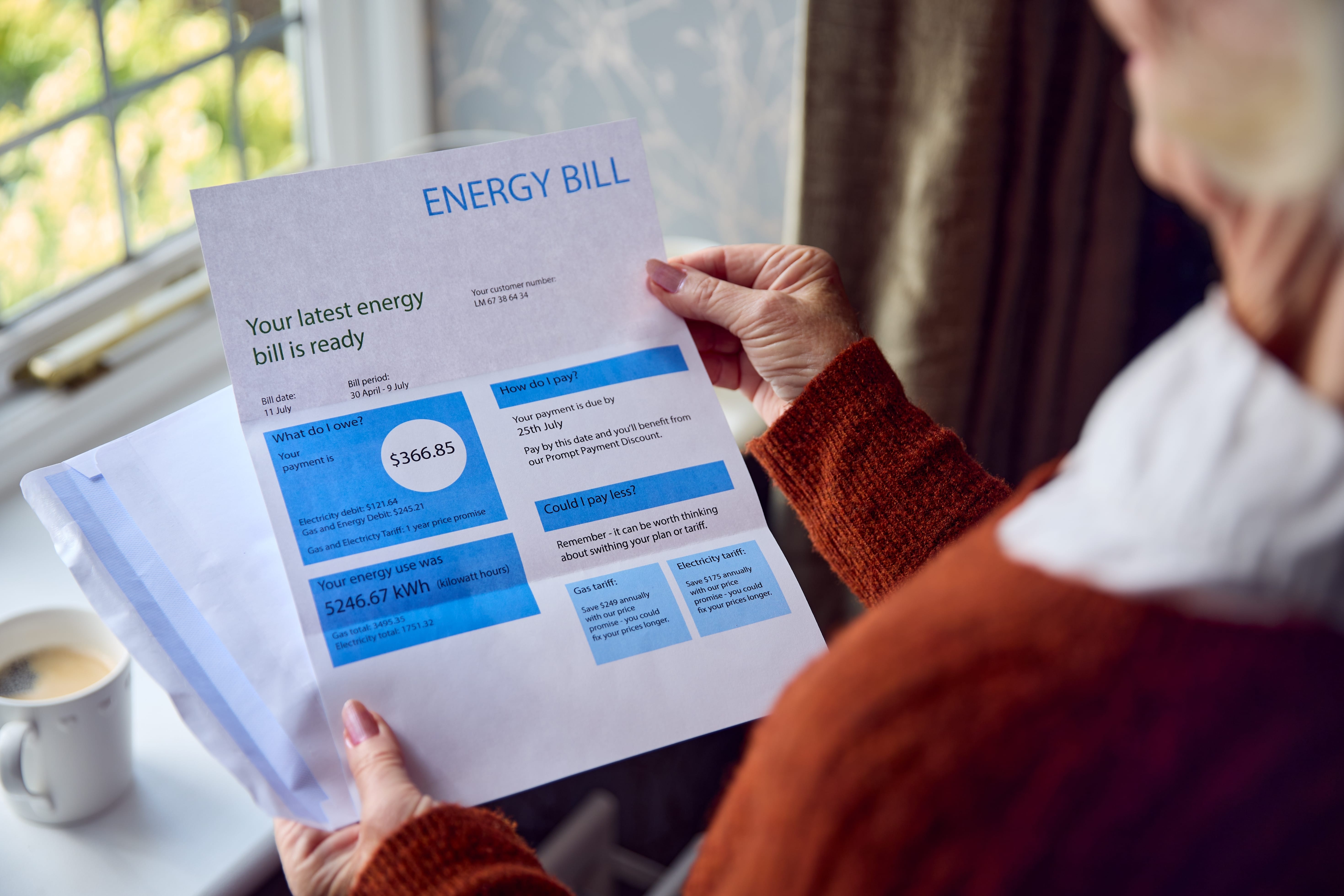

Make it a habit to monitor your utility bills closely for both usage and any potential errors. Many utility companies provide online tools or apps that allow you to track your usage over time so you can watch for patterns and get ahead of big deals. Watch for errors as well. From mistakes in meter readings to potential duplicate charges, common utility bill errors detract from your budget and cost you money, and you likely don’t realize it’s happening. Keeping an eye on monthly statements can help you identify areas where you can further cut costs, and keep watch over any errors.

Connect with Payment Plans, Guidance

Finally, if you are having trouble keeping up with utility bills, ask your utility company about a payment plan. Many companies offer a year-round plan that spreads costs out over 12 months. Sometimes called “level billing” or a utility payment plan, many find the billing plans helpful in that fluctuations in bill amounts are averaged out over the year to give you predictable bills and easier budgeting.

If you fall within a set income, State-based affordable payment plans might be available. These statewide programs provide energy assistance and self-sufficiency services to eligible low-income households.

If you are behind on your bills and would like to talk to someone, the trusted national nonprofit GreenPath can help you understand your situation and make a plan to meet your goals.